Do you ever feel like your money disappears the moment your paycheck hits the bank? You’re not alone. Living paycheck to paycheck, dreading bills, and feeling anxious about unexpected expenses is more common than you think. Many people avoid budgeting because they think it’s too complicated, they don’t earn enough, or they fear feeling restricted. But here’s the truth: a monthly budget template in Google Sheets can be your simple, stress-free solution.

You don’t need to be a math genius or a spreadsheet wizard. In just 30 minutes, you can build a personal finance tool that gives you clarity, control, and confidence. With the right system, you’ll go from worrying about money to planning your financial future with purpose—and yes, it’s free. Let’s transform your relationship with money starting today.

—

Building Your Budget Foundation

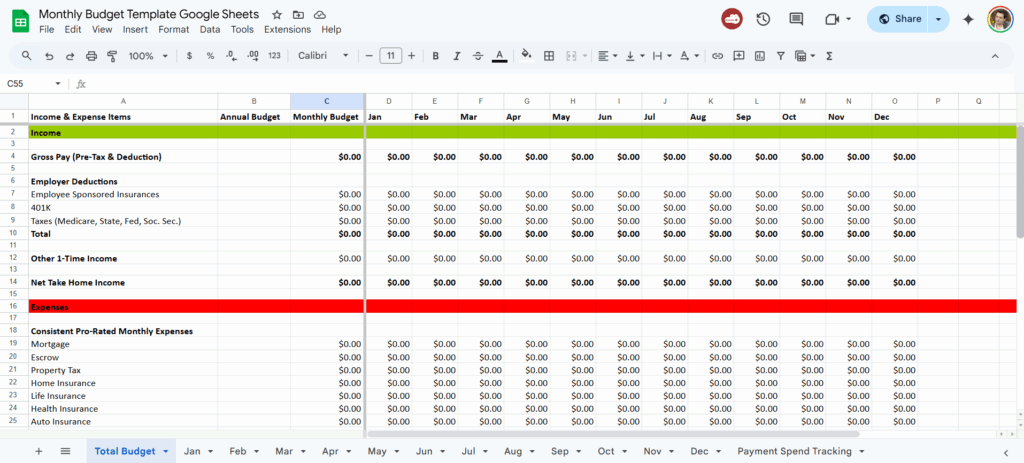

Getting started with budgeting doesn’t require fancy software or complicated systems. A basic Google Sheets budget can track all your income and expenses, helping you make smarter decisions with every dollar. Here’s how to lay the groundwork.

Four Essential Budget Categories

1. Income: Track all sources—salary, freelance gigs, side hustles. Use Google Sheets to list each stream and total with `=SUM(range)`.

2. Fixed Expenses: These don’t change monthly. Examples include rent, subscriptions, loan payments.

3. Variable Expenses: Things like groceries, gas, entertainment. They fluctuate, but can be averaged and controlled.

4. Savings/Goals: Set targets for emergency funds, vacation, or a new laptop. Even small amounts add up.

Google Sheets Basics

* Formulas: Use `=SUM(B2:B10)` to total your expenses. Try `=IF(B2>C2,”Over Budget”,”Good”)` to monitor limits.

* Formatting: Use color-coded cells to track spending categories—green for under budget, red for over.

Two Real-Life Success Stories

* Lina, a 28-year-old teacher, reduced \$3,000 in credit card debt in 8 months by tracking expenses and cutting takeout.

* Jason, a freelancer with irregular income, used a budget template to save \$5,000 for an emergency fund in one year.

Starter Template Recommendations

* Simple Template: One sheet with categories and monthly totals. Great for beginners.

* Detailed Template: Breaks down weekly spending, graphs, and savings trackers. Perfect for visual learners.

Beginner Mistakes to Avoid

* Overcomplicating the first sheet

* Forgetting to track irregular income

* Not including small purchases like coffee or digital subscriptions

Quick Setup Instructions

1. Open Google Sheets → File → New → From Template Gallery → Choose “Monthly Budget”

2. Customize category labels to fit your life

3. Input your income and expected expenses

4. Update weekly to track spending and progress

—

Supercharge Your Budget Template

Once you’re comfortable with the basics, it’s time to level up. Customization and automation can make your Google Sheets budget a powerful personal finance dashboard.

Goal-Setting & Progress Tracking

Use formulas to calculate how close you are to a savings goal.

Example:

`=B2/B3` → Where B2 is amount saved and B3 is your goal. Format as a percentage for quick progress checks.

Add conditional formatting to turn cells green at 100% completion.

Debt Payoff Strategies

Set up a debt snowball table with columns for debt name, balance, minimum payment, and payoff date.

Formula example:

`=IF(B2>0,B2-C2,0)` → Subtract your payment from the balance.

Use filters to prioritize smallest debts first. Celebrate every milestone.

Emergency Fund Planning

Create a “Safety Net” sheet.

Column A: Month

Column B: Target Amount

Column C: Actual Savings

Use `=IF(C2>=B2,”✔”,”Keep Saving”)` to visually track progress.

Customization for Different Lifestyles

* Freelancers: Include a section for quarterly taxes and unpredictable income.

* Students: Track loan disbursements and set a textbook savings goal.

* Families: Add childcare, groceries for four, and school expenses.

Useful Google Sheets Functions

* `=VLOOKUP()` to search for transaction categories

* `=AVERAGE(range)` to estimate variable spending

* `=COUNTIF(range,”>500″)` to monitor big-ticket expenses

Common Customization Ideas

* Tabs for each month

* Pie charts showing spending distribution

* “No Spend Days” tracker

* Monthly comparison bar charts

—

Making Budgeting Effortless

Maintaining your monthly budget template doesn’t have to be time-consuming. With the right systems, budgeting becomes a 10-minute habit, not a chore.

Weekly and Monthly Review Routines

* Weekly: Every Sunday night, log receipts and check your totals

* Monthly: First of the month, duplicate the sheet, reset categories, and review progress

Mobile Access & Updating

Use the Google Sheets app to track expenses on the go. Record spending in real time instead of saving receipts.

Automation and Alerts

* Conditional Formatting: Red cells for overspending (`=IF(B2>C2)`), green when on target

* Email Reminders: Use Google Calendar to set budgeting sessions

* Linked Sheets: Connect your expense log to your dashboard with `IMPORTRANGE`

Time-Saving Shortcuts

* Use template duplication to avoid starting from scratch

* Create drop-down menus for expense categories

* Apply filters to quickly sort and find spending habits

Integrating with Other Tools

* Use Google Forms to log daily spending into Sheets

* Sync with Tiller Money (for advanced users) to pull data automatically

* Export to PDF for printable summaries or accountant reports

—

Conclusion: Your Budgeting Breakthrough Starts Now

Budgeting isn’t about restriction—it’s about clarity and control. And the more you practice using your Google Sheets budget, the better you’ll become at managing your personal finance. Don’t worry if your first month isn’t perfect; progress matters more than perfection.

Take the first step: download your free budget template, personalize your categories, and track just one month. That simple action can spark a life-changing shift in your money mindset. Another Google Sheet Template for personal budget

You deserve financial freedom. And with the right tools, it’s 100% within reach—one formula, one entry, one goal at a time. Let’s make budgeting your new superpower.